Getting a loan to buy a car is simpler today than ever before. There are several options to choose from and car financing is on your terms much more than it is on the lender's terms. This is because there are so many

lenders both online and off who are competing for your business. Even with poor credit, car financing is not difficult to get. Take advantage of the extremely low interest rates available right now. You can even refinance a current car loan. Take some time to shop around for a loan and you will be rewarded with low monthly payments.

The amount you can borrow depends very much upon the lender you are considering and how much the loan costs. It also is dependent upon what you earn in your regular monthly wage.

When someone goes out and finances a new car with an

auto loan, in most cases the loan is arranged through the auto dealership itself. New car loans are usually the ones you see advertised on television. With new car loans, because the dealership is affiliated directly with the lending company, there is a lot of flexibility. It is the new car loans that will sometimes offer zero-down financing or 0% interest rates.

Once the loan debt is paid off, a person enjoys a greater credit score. But if the loan was in joint name, then both the partners would enjoy a greater credit score on the basis of the same loan.

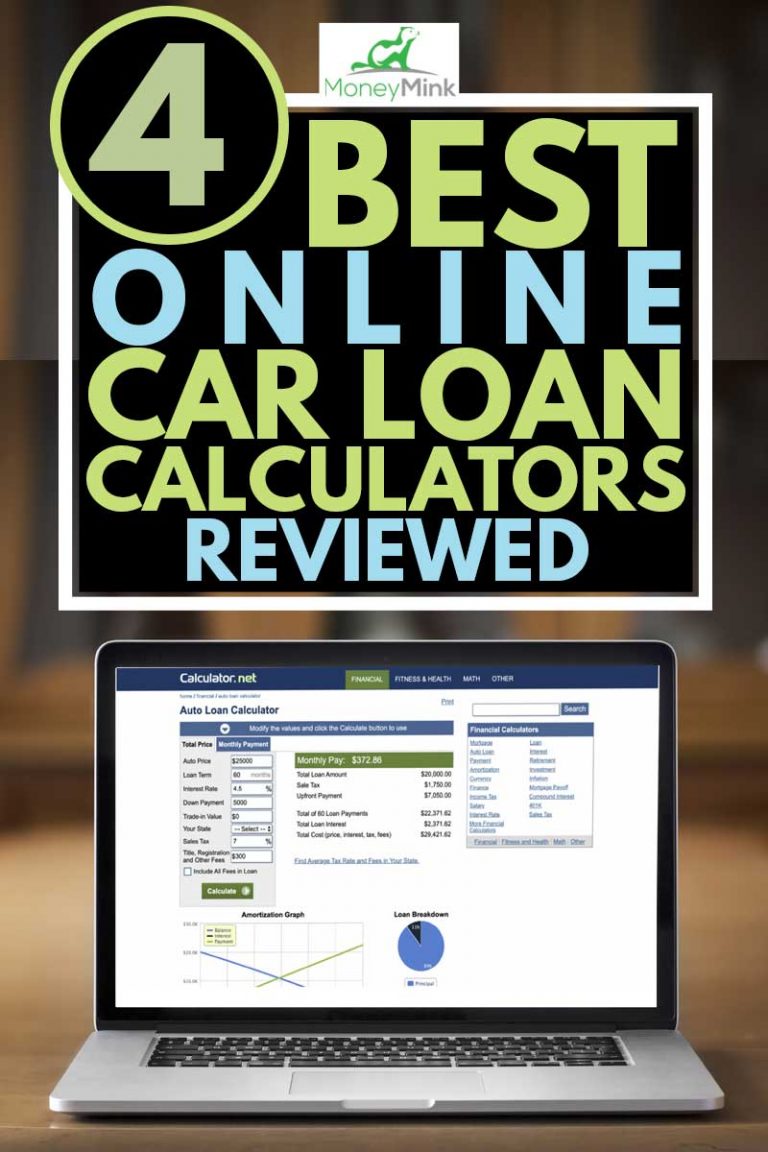

1) Come to terms with terminology: Only once you come to terms with the language and terminology involved with car loan calculator, will you be able to understand how easy it is to use car loan calculator. The first one is monthly payment which as the name suggests deals with the amount of money that you have to pay each month. The second is the buying price. In a normal sense, this usually indicates the price tag of the car. The third one is terms which refer to the length of the loan. The others involved are trade, trade balance, interest, cash down and tax rate.

It is very easy to compare rates for online auto finance with the help of an auto

debt to income ratio calculator, provided at most auto finance sites. All you need to do in order to use this calculator is input the relevant data that you are thinking of finalizing. Generally, you need to know the value of the car, the interest rate, and either the length of time you want to pay off, or the amount of money you are ready to pay monthly for the installment. Once you feed all this information into the calculator, it will show you how good that deal is. You can write those numbers down and compare them with other finance options you are looking into. This way you are sure to find the

best auto loan solutions deal for the loan.

Determine if you have any money to put down. Putting money down with your

auto loan calculator refinance can also lower your payments even more. Putting down increments of $1,000 will on the average lower your payment by $20.00 a month.

Indeed, you should pay full attention that you have to pay exit fees of the debt contract that you have right now. What does this mean? For example, when you sign up for a new car finance, they will state in the contract that in case you decided to end it for whatever reason, you will have to pay.

The purpose of a personal loan calculator is to allow you the opportunity to make comparisons so that you can have control of your finances before making long or short term commitments. It is only the borrower who is fully prepared who can make a loan work.